The art market, which until recently was regarded as a bastion of stability and growth, is now experiencing difficulties. Figures published by Britain’s Financial Times show that legendary auction houses such as the Sotheby’s and Christie’s, are facing declining revenues. What is the current situation in the art market. What could be its causes and consequences for investors? Is it a crisis in the art market, or a temporary correction or symptom of oversaturation?

Art market crisis. Giant declines at auction houses.

Sotheby’s reported an 88 percent drop in profits in the first half of 2024, a 22 percent reduction in revenue compared to the same period last year. An example of one recent event – the auction of a Francis Bacon portrait – illustrates the difficulties. The artwork did not even reach the lower limit of the expected amount of $30-50 million.

Christie’s, which announced a 22% drop in auction sales, also suffered similar problems. These figures show that the difficulties in the art sector are widespread and not limited to just one auction house. Art market crisis is a new phenomenon. So far, it has been considered stable and developing.

Reasons for slowdown in the art market

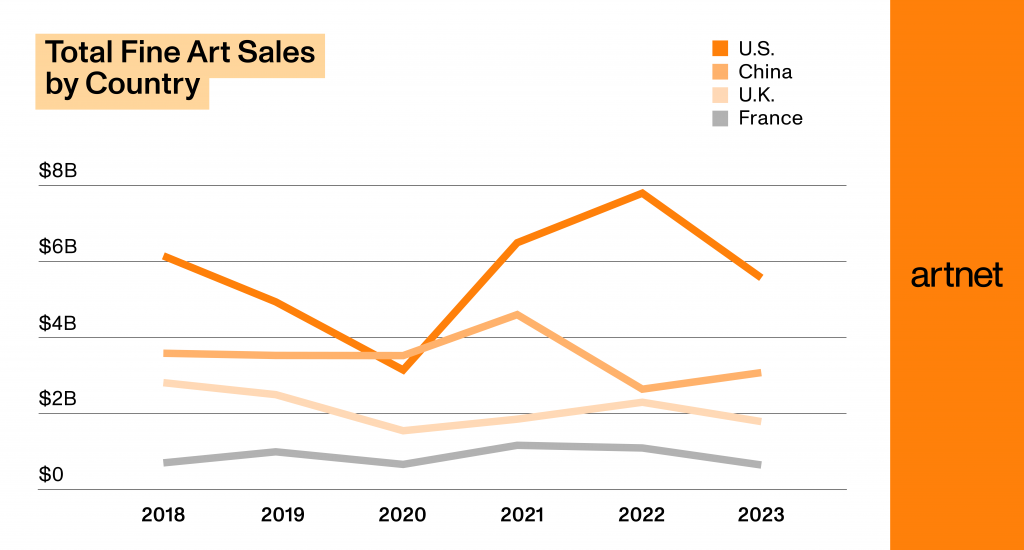

One of the factors behind the decline in auction house revenues is the reduction in spending on luxury goods in China. The once thriving art market in the region is now struggling economically. This is affecting global demand for artworks.

In addition, Sotheby’s is under financial pressure related to debt. In August of this year, the auction house entered into an investment agreement with the Abu Dhabi Fund, which took a minority stake in the company, raising $1 billion in capital. The fund, ADQ, aims to support growth in the Emirate, but also to reduce Sotheby’s debt.

Temporary problem or permanent change?

While the current difficulties may suggest a temporary crisis in the art market, it is also possible that we are facing a long-term shift in the luxury goods market. The problem is also felt by fashion houses recording declines. The price of gold, on the other hand, is rising.

But for investors, it can also be an opportunity to buy artwork at lower prices. A huge opportunity for those with a long-term perspective.

Verification of investment portfolio

For investors operating in art market The moment has come when you should carefully review your portfolio. Declining auction values may require rethinking your investment strategy. Adapt to changing market conditions. Monitoring trends is important. An important willingness to adapt in the face of economic uncertainty and changing buyer preferences.

Art market crisis – what about collections?

The current difficulties in the art market are manifested decline in income In leading auction houses. They are a signal for investors to be cautious and rethink strategy. The reasons for the slowdown are complex and related to global trends. There is also the potential to find opportunities to buy valuable artworks at lower prices. However, established collections are still valuable and their value is not in dispute.

Luxury News Editor

Malcolm Lux

Source: Financial Times

Company: Sotheby’s, Christie’s